Top Social Security account Secrets

Top Social Security account Secrets

Blog Article

The rep was capable of see that her mom’s direct deposit information were altered in early December, the month just before the benefits vanished.

Normal in additional working several years. Social Security Rewards are now based upon a mean of the employee's 35 maximum paid out annual salaries with zeros averaged in if you will find much less than 35 yrs of included wages.

I asked her to eliminate me from her checklist. She hung up on me. I identified as her again and advised her to get rid of me from their listing. She claimed the knowledge she was inquiring wasn’t particular. I stated yet again to eliminate me and she or he hung up on me again. It was a neighborhood amount from Noble, Okay. 405-294-9585. She said her identify was Evelyn.

Federal, state and local workforce who have elected (when they may) NOT to pay FICA taxes are qualified for the reduced FICA Rewards and whole Medicare coverage if they have a lot more than forty quarters of qualifying Social Security covered operate. To attenuate the Social Security payments to all those who have not contributed to FICA for 35+ years and are qualified for federal, point out and local Added benefits, which are often additional generous, the U.

It is possible for railroad staff to have "coordinated" retirement and disability Gains. The U.S. Railroad Retirement Board (or "RRB") is surely an impartial company in The chief branch of The usa government created in 1935[81] to administer a social coverage plan providing retirement Added benefits for the region's railroad staff. Railroad retirement Tier I payroll taxes are coordinated with social security taxes in order that workforce and employers spend Tier I taxes at exactly the same rate as social security taxes and possess a similar Gains.

Social Security is sort of common, with 94 p.c of individuals in paid work in America working in protected employment.

It's essential to be at least age sixty two for the entire month for being eligible to acquire Gains. In the event you ended up born on the main or next day from the month, you meet up with this necessity in the month of your 62nd birthday.

Our workers won't ever threaten you for details or assure a profit in Trade for personal info or income.

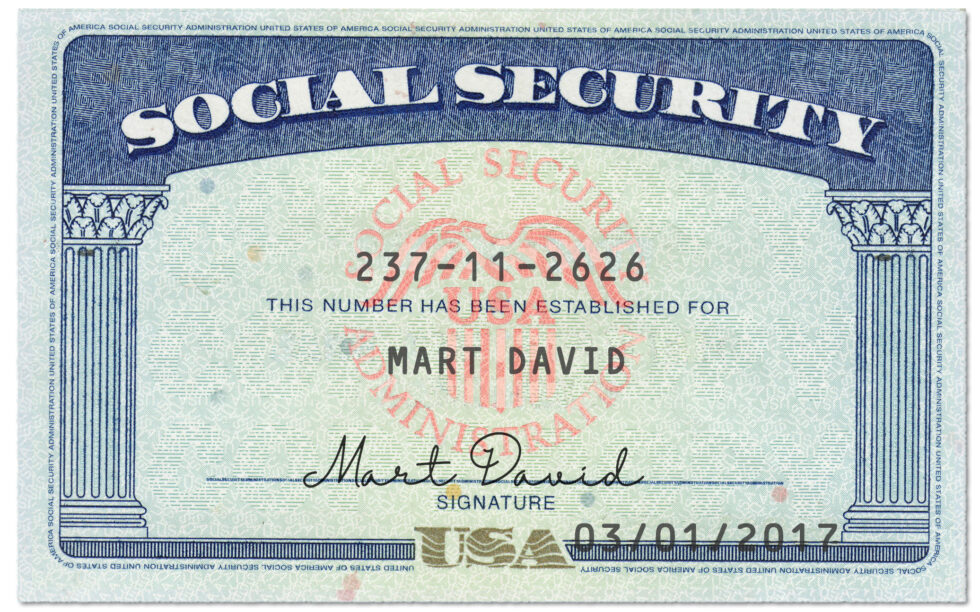

We have now quickly expanded our plan to just accept secondary identity files. All submitted paperwork should be possibly originals or Qualified copies through the issuing agency. We are unable to settle for photocopies or notarized copies of files.

The amount of hearings requested and availability of ALJs differs geographically across The usa. In some regions of the nation, it is achievable to get a claimant to possess a hearing with an ALJ inside 90 days on the ask for. In other parts, ready occasions of 18 months will not be unheard of.

When Helvering v. Davis was argued ahead of the Court docket, the larger problem of constitutionality on the previous-age coverage part of Social Security wasn't resolved. The case was restricted to if the payroll tax was a suitable usage of Congress's taxing electric power.

In the event you’re struggling to submit an application for a click here substitute card online, consider our Social Security and Coronavirus Web content, less than “Social Security Quantities and Cards” heading, for facts about the documents you have to mail in with your Social Security card software to check here secure a alternative card. We quickly expanded our plan to simply accept secondary identity paperwork.

I gave it to her after which you can became suspicious…. I explained to her I used to be providing her no a lot more solutions and was going to contact SS. I hung up. Need to I be worried about offering the data that I did ????

Critics have drawn parallels involving Social Security and Ponzi strategies,[177][178] arguing that the sustenance of Social Security is due to ongoing contributions after a while. A single distinction between a standard Ponzi plan and Social Security, is that even though each can have identical structures—in particular, a sustainability issue when the volume of new folks spending in is declining—they've differing levels of transparency. In the case of a traditional Ponzi plan, The actual fact that there is no return-making system apart from contributions from new entrants is obscured[179] whereas the Social Security scheme is designed to have payouts brazenly underwritten by incoming tax profits as well as interest about the Treasury bonds held by or to the Social Security scheme.